Insights

Lanteri Partners Group develops and implements tailored financial plans that create, build and protect your wealth.

We have achieved excellent outcomes for our clients for more than 30 years because we are lateral thinking, dedicated and experienced people. Our advice is driven by solutions not products and guided by the latest and most up to date information .

Subscribe to Lanteri Partners Insights to stay up to date with the latest news and industry updates delivered straight to your inbox.

July Newsletter 2020

We also consider the issue of passive income and where this figures when qualifying for JobKeeper. There has also been a temporary change made to bankruptcy laws because of the economic fall-out of COVID-19. We also consider the issue of passive income and where this figures when qualifying for JobKeeper. There has also been a…

May Newsletter 2020

There are many questions being asked lately about claiming expenses when forced to work from home over the COVID-19 period, plus a lot of concern about any consequent capital gains issues when later selling a property from which people have been coerced to work from during this time.

April Newsletter 2020

There are many questions being asked lately about claiming expenses when forced to work from home over the COVID-19 period, plus a lot of concern about any consequent capital gains issues when later selling a property from which people have been coerced to work from during this time.

March Newsletter 2020

If you own certain high-end assets, it may be prudent to make sure your tax affairs are in order. The ATO has asked dozens of insurance companies for policy details over certain asset values to check up on these taxpayers’ tax obligations. We also look at the realities of accessing some of your retirement savings…

February Newsletter 2020

The bushfire season has highlighted the very central importance that volunteers play in Australia, but along with these essential roles there can also be tax outcomes to consider. We also sketch out the essentials to know about the First Home Super Saver scheme, succession planning for family businesses, and the possible tax offsets available in…

December Newsletter 2019

Sometimes small business owners pass up the at-times lucrative small business CGT concessions simply through not knowing that they are eligible to claim them. Answering a few basic questions can clear this up. We explain how the “personal property security register” can help manage the risk that comes with owning certain assets. We also take…

November Newsletter 2019

Sometimes, essential tax records are missing or even destroyed. But all is not lost, as there is a “plan B” that can be put into affect, so we run through the options to help your tax outcome. The investment strategy of any SMSF is not “set-and-forget”, and if not re-visited from time to time, could…

October Newsletter 2019

Deductible work-related expenses are always tempting to chase down, but to stay out of trouble with the ATO it’s always good to have fact sorted from fiction. We also look at the special CGT rules that apply when spouses have different residences. There’s an exemption from reporting obligations for employers for certain “personal security” fringe…

September Newsletter 2019

Property developers often feel the gaze of the ATO on their activities, so we look at what could be getting its attention. Still on residences, we look at some little known facts about the CGT exemption that generally, but not always, applies to inherited homes. Also dealt with is the tax that children’s savings accounts…

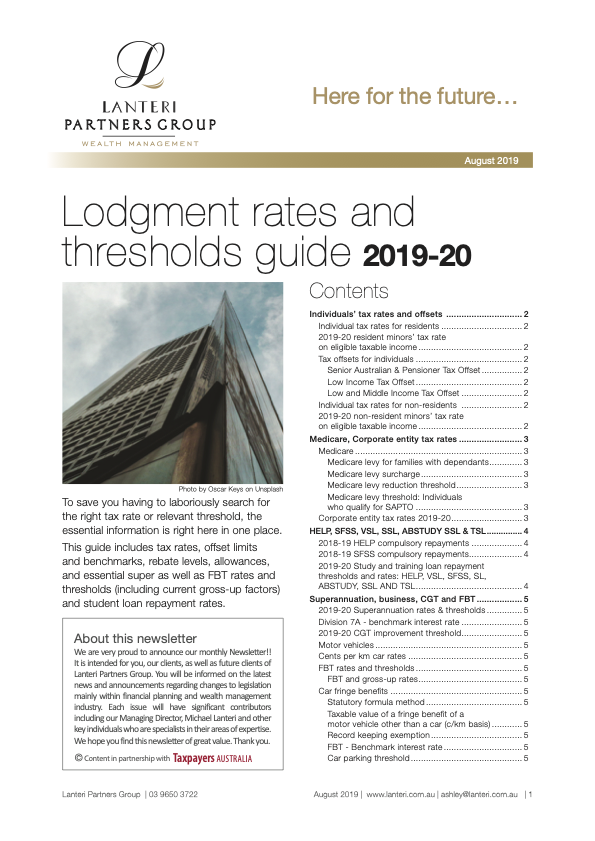

August Newsletter - Lodgement Rates Edition

Property developers often feel the gaze of the ATO on their activities, so we look at what could be getting its attention. Still on residences, we look at some little known facts about the CGT exemption that generally, but not always, applies to inherited homes.

August Newsletter

Heading overseas for that trip of a lifetime? There could be a few simple steps you can take to ensure all is in order tax-wise, both while you¹re away and after you return. We also look at trust distribution resolutions, whether your backyard projects are considered a business or a hobby by the taxman, and…

July Quarterly Report 2019

Heading overseas for that trip of a lifetime? There could be a few simple steps you can take to ensure all is in order tax-wise, both while you¹re away and after you return.We also look at trust distribution resolutions, whether your backyard projects are considered a business or a hobby by the taxman, and simple measures to be aware of that can reduce the tax you pay on your small business.

June Newsletter 2019

Heading overseas for that trip of a lifetime? There could be a few simple steps you can take to ensure all is in order tax-wise, both while you¹re away and after you return.We also look at trust distribution resolutions, whether your backyard projects are considered a business or a hobby by the taxman, and simple measures to be aware of that can reduce the tax you pay on your small business.

May Newsletter 2019

Heading overseas for that trip of a lifetime? There could be a few simple steps you can take to ensure all is in order tax-wise, both while you¹re away and after you return.We also look at trust distribution resolutions, whether your backyard projects are considered a business or a hobby by the taxman, and simple measures to be aware of that can reduce the tax you pay on your small business.

December Quarterly Report 2018

Heading overseas for that trip of a lifetime? There could be a few simple steps you can take to ensure all is in order tax-wise, both while you¹re away and after you return.We also look at trust distribution resolutions, whether your backyard projects are considered a business or a hobby by the taxman, and simple measures to be aware of that can reduce the tax you pay on your small business.